An Automatic Wireless Water Pump Controller

After watching and experiencing turning off and on our household water pump manually, it was really hectic and frustrating. It happened many times when you stay alone at home and while using the bathroom, the overhead tank got emptied and you were hassled. Even the opposite happened when you turned on the pump and forgot to switch it off, causing heavy water and power wastage. This leads us to make a circuit that can automatically turn the pump off or on depending on the level of water. Meanwhile building the circuit we came across that the water level measurement happens to the overhead tank which is usually placed on the terrace of the apartments and the pump is located on the ground floor. Now the cost of the wire of that length is huge. So we thought of making it wireless, and that too using simple components that are very cheap and affordable. And you can build the whole system under $3 or $4. Check out our previously built electronic circuits to learn more.

Also check our previous water level monitoring projects:

- Simple Water Level Indicator Alarm with Buzzer

- Automatic Water Level Indicator and Controller using Arduino

- How to Measure Water Level using JSN SR-40T Waterproof Ultrasonic Sensor

What it does?

The circuit automatically turns on and off the pump that fills the tank by monitoring the level of water inside it. After reaching the upper threshold the pump turns off and after going below a lower threshold the pump turns on. The wireless control cuts the cost of wire that needs to be connected from the tank to the pump circuitry.

Component Required for Wireless Water Pump Controller

Project Used Hardware

- RF modules,

- CD40xx CMOS digital Logic Family,

- PCB

Project Used Software

- EasyEda

Project Hardware/Software Selection

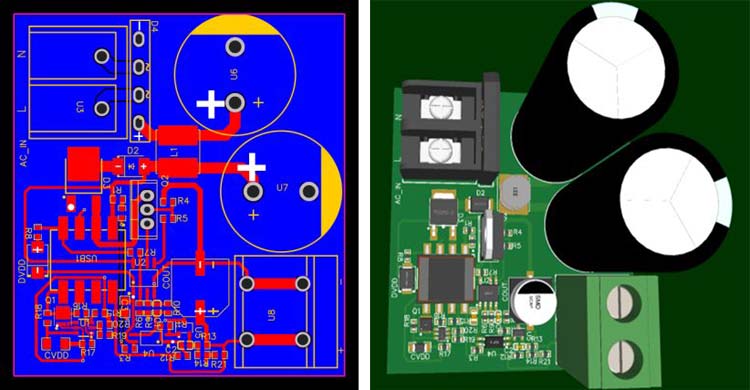

The hardware logic is purely built using Logic gates, more specifically just a bunch of NOR gates(universal it is). we used CD4001 quad Nor gates to develop our sequential logic and build the circuit. And since we are making the wireless, so we used simple RF modules to send the ON or OFF signals to the Water Pump. EasyEDA was used for designing the PCBs.

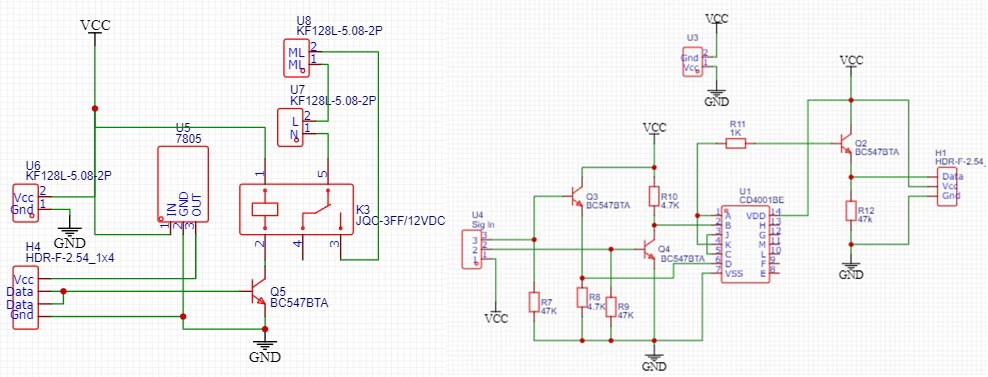

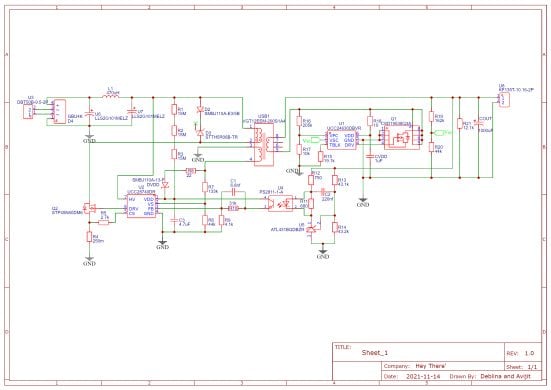

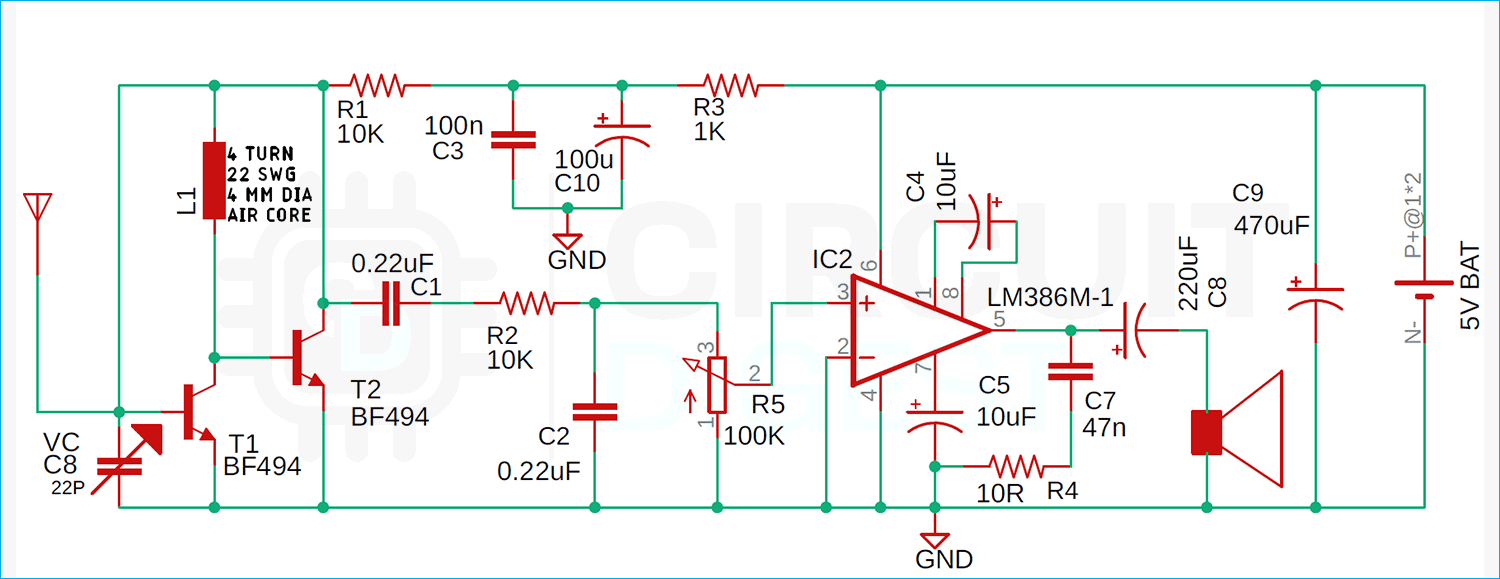

Automatic Wireless Water Pump Controller Circuit Diagram

The project contains two schematics. 1. The measurement and transmitting circuitry, that measures the water level, and transmits ON or OFF signal i.e a high or low. In the circuit, we have three wires that connects to the screw terminals as the measuring input, from there it gets fed to the sequential logic made by the NOR gates CD4001 which is used to trigger the when the water inside the tank is empty and stop when the water is full. This signal is now fed to a 433MHz RF transmitter that transmits the desired signal. 2. The receiving and driving circuit that receives the ON or OFF signal by the RF receiver and drives a relay which will turn the Motor ON or OFF.

How we built it?

The system consists of two circuits, one, measuring the level of the water, latching control, and transmitting the on-off signal. Two, receiving the on, off signal and driving the relay to turn on and off the pump. The measurement is done using naked wires acting as leads, placed at two different heights(upper threshold and lower threshold). Don't worry it is safe to use the naked wires since it is powered by LV +5v. The control circuitry contains a sequential logic circuit that was built according to the truth table modeled for the output whenever going high. Now the output is fed into a 433Mhz RF transmitter that sends the ON and OFF signal. The RF receiver receives the ON and OFF signal and turns the relay on and off accordingly. The relay will be responsible to turn ON and OFF the HVAC pump.

Advantages of using Varun

Saves Power: Using a water level controller saves power. This is because water levels are controlled automatically, which limits the amount of electricity used. As a result, less water and power are used to regulate a water supply. In an age where energy conservation is of utmost importance, using one of these devices is very beneficial. -Cost-Effective: Since a water level controller conserves power, it saves money, as well. Basically, water regulation is optimized through these devices, which means that wasted electricity and wasted water are kept at a minimum. That saves a substantial amount of money over time. Also, the advantage of making it wireless is to reduce the cost of the wires that are required to connect the sensing end and the controlling end. -Works Automatically: It can work on its own. There is no need to operate them manually thanks to timer switches. This means that the frustrations involved with monitoring something like a water tank are minimized, and the water levels will be where they should be. -Sustainable Water Usage: Additionally, water usage can be maximized with a water level controller. Often, water pumps get more use during the middle of the day. A water level controller is helpful because it automatically provides more water during the middle of the day and less water at night. As a result, water remains at its appropriate level at all times. -Challenges we ran into The RF modules we bought were not perfectly tuned and were not responding correctly. So we got stuck there really badly for a long time. We figured it out later, that a small variable inductance is there by which the inductance can be changed and thus the frequency. Making the leads for measuring the level of water was a bit challenging as it required some amplification to turn the inputs high. We used two transistors here. -Accomplishments that we're proud of Tuning the RF transmitter and the receiver really got us a break. Modeling the control circuit using sequential digital logic, and implementing it using three NOR gates was great. And of course, the final step, where the circuit works like a charm.

What we will learn?

We learned to model real-time tautology to digital logic using a truth table and thus implement it with logic gates. We studied latches in semesters, but never thought why by using two nor gates in that configuration. This project helped us to know deep about it and got a good grasp of sequential logic. We also learned about RF communication between two cheap RF modules.

Reason behind the project name One of our team member's mothers suggested the name 'Varun' for this project because in Indian Hindu mythology, the name of the Water God is said to be 'Varun', and since our project deals with the flow and conservation of water, we found this name suitable for our project. Therefore 'Varun' is a project not only spreads and glorifies the notion of 'save water, save life', but also shows immense respect towards the said community's history.

What's next for Varun

Ordering a PCB for it and gathering components so that we can make it professionally and use it, in our apartments, to test further reliability. Using a solar cell to power the transmitter unit consumes very low power in the order of 2mA. With that being said we can use this circuit in agricultural fields for irrigation.

- Read more about An Automatic Wireless Water Pump Controller

- Log in or register to post comments

Adam Kimmel has nearly 20 years as a practicing engineer, R&D manager, and engineering content writer. He creates white papers, website copy, case studies, and blog posts in vertical markets including automotive, industrial/manufacturing, technology, and electronics. Adam has degrees in chemical and mechanical engineering and is the founder and principal at ASK Consulting Solutions, LLC, an engineering and technology content writing firm.

Adam Kimmel has nearly 20 years as a practicing engineer, R&D manager, and engineering content writer. He creates white papers, website copy, case studies, and blog posts in vertical markets including automotive, industrial/manufacturing, technology, and electronics. Adam has degrees in chemical and mechanical engineering and is the founder and principal at ASK Consulting Solutions, LLC, an engineering and technology content writing firm.