In this article, we are going to discuss how to transfer audio through laser light. This is a fun little project, and the concept is similar to what we see in fibre optics cable. We will use a laser light to send data from one point to another. To be particular, in this project here, we are going to transfer our voice from one point to another by shining a laser light on a solar panel. This is made possible by Light Fidelity or (Li-Fi) in short, for those who are new, Li-Fi is a technology in which data can be transferred using light. In our case, we are sending our voice as data and using a Laser as a light source.

The highlight of this project is its simplicity; you can easily build this over a weekend with commonly available components. If you are interested in Li-Fi, you can also check our Li-Fi Text communication and Li-Fi audio transfer projects.

So, without further delay, let’s dive into building the project.

Discover how to create a project that uses a laser audio transmitter and receiver to wirelessly transmit sound, voice, and music through the use of laser light itself. This project involves the transmission of an LiFi audio transmission to transmit audio data over a focused laser beam, replicating the same technology used in fibre optic communications. Our wireless audio transfer using laser light has been tested and achieves clear audio transmission over indoor distances of 50 meters and outdoor distances greater than 100 meters.

How Laser Audio Transmission Works

Transmitting Audio via Laser light is simpler than it sounds. On the transmitter side, we have a microphone which converts our voice into electrical signals. This signal is then amplified using an audio amplifier, and the output of this amplifier is directly connected to a LASER diode. This light is then pointed towards the solar panel on our receiving circuit. Again, on the receiver side, the solar panel is connected as an audio input for another audio amplifier, which amplifies these signals and plays them on a speaker. All of this works because of the ability of light to carry data. A laser transmitter and receiver system works by converting audio signals into modulated light waves. Understanding this laser audio transmitter circuit operation helps you troubleshoot and optimise your build.

Transmitter Side

→ Audio to Electrical Signal:

We aim to transfer the live audio signal, so in that case, we need some sort of microphone to convert the audio signal to an electrical signal. Actually, speaking, there comes a little bit of a complex circuit to achieve a perfect output. So, to make it simple, we are going to use the MAX4466 Microphone Amplifier Module. You can check out the link if you want to know more about this microphone module. The laser transmitter receiver principle relies on the photoelectric effect.

Above, you can see the GIF video representing the working of the MAX4466 Microphone Amplifier Module. Now we have the electrical signal that needs to be transmitted over the laser.

→ Electric Signal to Laser Beam:

In the above process, we have received the electrical signal. Now this electrical signal is used to drive the laser light beam. It can be done using multiple ways, like using some analog circuits (i.e., switching MOSFET). But to make it simple and more effective, we are using a Mini 5V Audio Amplifier Module based on PAM8403, as you can see in the image below.

The reason behind choosing this is simple. It works in the 5V range, so it can be easily integrated with the MAX4466 Microphone Amplifier Module. It also has an inbuilt potentiometer to adjust the amplitude of the output, and more importantly, it is more affordable. You can use whatever amplifier board you have or even create your own circuits to do the job right. Still, I suggest using the audio amplifier board for better output and hassle-free work. We have previously used the PAM8403 to also build a simple DIY Bluetooth speaker; you can check that out if you are interested.

Now, a laser diode can be connected to the output of the PAM8403 module.

Above, you can see the laser diode we are using. If you would like to reduce the current fed to the laser, you can use a resistor of minimum value. Here, the laser we are using has a built-in 30-ohm resistor in series with the power input. If you feel like reducing the power, you can do so by adding an extra resistor in series or even adjusting the potentiometer in the PAM8403 module.

Receiver Side

→ Laser Light to Electrical Signal:

As in the last step, we have already completed the transmitter side; here we go with the receiver side. So the primary process is to convert the audio signal from the laser light beam to its original state of an electrical signal. Here, generally, we can use any light-based sensor (i.e., LDR, photodiode, etc.) to do the job right, but those with smaller reception areas are quite tough to use. However, they are not unusable; you can even use them. But here in this project, I am going to use a larger array of photodiodes, which is also known as the solar panel.

I am going to use a small toy solar panel. Despite its minimal power output, it is more than enough for our project. So, by using this solar panel, we are going to convert the laser beam to an electrical signal.

→ Electrical Signal to Speaker:

The electrical signal from the solar panel cannot be directly fed to the speaker due to its low power output. Even with a larger solar panel, the small point of light hitting the panel doesn't make a significant change in the output; we will only get a higher DC voltage with a larger panel. However, we need an analog voltage.

To solve this issue, I am going to use the same amplifier module that we used on the transmitter side so that the output electrical signal can be effectively amplified and passed to the speaker.

Regarding the speaker, you can use any speaker compatible with your amplifier module. I am using a 4-ohm, 10-watt speaker, as shown in the image above.

Therefore, we have completed the theory part. I hope you all understand the main concept behind choosing the components and the workings of the project. So, let’s move on to the hardware part of the project.

Components Required for Laser Audio Transmitter Circuit

Below is the list of required components to build the Wireless Audio Transfer using a laser light project. Some components may have alternates. This laser audio transmitter and receiver project uses commonly available components. To learn more about that, read the “Concept of Audio Transfer Via Laser - Explanation” available above.

- Solar Panel - x1

- Laser Diode - x1

- Resistor (30 ohms) - x1

- Potentiometer (100k) - x1

- Speaker (4 ohms, 10W) - x1

- MAX4466 Microphone Amplifier Module - x1

- 7805 5V Voltage Regulator - x2

- PAM8403 Audio Amplifier Module with Potentiometer - x2

- 9V Battery - x2

- BreadBoard - x2

- Jumper Wires - Required Quantity

Building the Laser Transmitter Circuit

Here, this project is built by keeping in mind that to make it easy and use only Minimal components. So, as an outcome, the circuit is simple for Everyone to understand and recreate.

Transmitter Circuit Construction

Here you can see the Schematic of the transmitter part. Those connections are self-explanatory.

We can split the schematic into two parts: The power and Transmitter sections.

⇒ Power Section:

Here, the power source selected is a 9V battery. Since the rest of the circuit operates at 5V, I am using a 7805 5V Linear Voltage Regulator to effectively convert 9V to 5V.

⇒Transmitter Section:

In this section, only four components are being used.

Both the MAX4466 and PAM8403 modules are powered using the 5V output from the voltage regulator. The output of the MAX4466 Microphone Amplifier Module is connected directly to the PAM8403 Audio Amplifier Module.

The PAM8403 supports 2 channels. You can use one channel alone or use both channels as I have. However, we are going to drive only one laser. The laser's positive and negative terminals are connected in parallel with one of the channels. While connecting, I have mentioned using a 30-ohm resistor in series. This is for limiting the current flowing through the laser diode. If you are using the same laser diode as me, this resistor is not needed, as it already has a 30-ohm resistor connected internally.

Building the Laser Receiver Circuit

Below you can see the schematic of the receiver part. You might notice a similar power section here, like the transmitter part, as our requirement is still the same. We are powering the system using 5V. The receiver section of this LiFi audio transmission project converts the optical signal back into audible sound. This laser transmitter and receiver pair demonstrates complete optical communication.

Receiver Circuit Construction

Here, the solar panel’s negative side is grounded, and the positive side is connected to the input of the PAM8403 Audio Amplifier Module. Like the transmitter, I kept both input channels connected. An extra step is applying the bias voltage to the input using a potentiometer, which sets the DC offset to the input of the amplifier. Finally, a speaker is connected to the output of the PAM8403 amplifier module.

That completes our circuit. Next, let us move on to the assembling part.

Testing the LiFi Audio Transmission Project

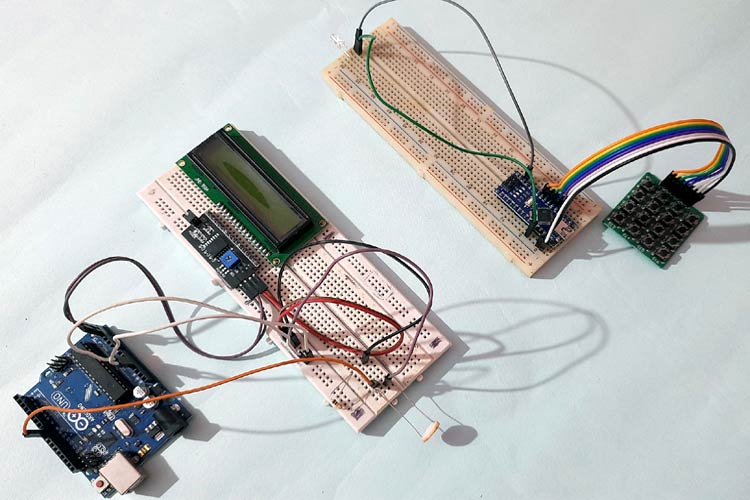

Let's build the circuit according to our schematic. I am using a breadboard to assemble all the components. Follow this systematic testing procedure to verify that Building the Laser Receiver Circuityour laser audio transmitter and receiver project works correctly.

Above, you can see the assembled image of the transmitter with its parts marked for your reference. The laser diode is directly soldered to a 2x2 Berg strip connector, allowing it to be easily fixed to the breadboard. Similarly, the battery connector is also fitted with a Berg strip for easy breadboard integration.

In this transmitter, there are two configurable areas. One is the gain adjustment in the MAX4466 Microphone Amplifier Module, which controls the sensitivity of the microphone. The other is the amplitude adjustment in the PAM8403 module, which controls the output power to the laser diode. These configurable options allow for precise signal control.

Above, you can see the assembled image of the receiver. Parts like the speaker, solar panel, and battery are connected to the breadboard using Berg male strips, which I have soldered to the wires and fixed to the breadboard.

Like the transmitter, the receiver also has two configurable options. There is a potentiometer connected to the input of the PAM8403 module, which is used to set the DC offset to the input signal. The PAM8403 module itself has a potentiometer to adjust the amplitude of the signal going to the speaker, effectively allowing volume adjustment.

With this, we have completed building the circuit as per the schematic diagram. Next, a Working demonstration.

Comparison: LiFi vs WiFi vs Bluetooth

Understanding where your laser transmitter and receiver technology fits in the wireless communication landscape:

| Feature | LiFi (Laser Audio) | WiFi | Bluetooth |

| Data Rate Potential | High (Gbps theoretical) | Medium-High (Mbps-Gbps) | Low-Medium (Mbps) |

| Range | Medium (10-100m line-of-sight) | High (50-100m through walls) | Low (10-30m through walls) |

| Security | Excellent (cannot penetrate walls) | Good (encryption required) | Good (encryption required) |

| Line-of-Sight Required | Yes (major limitation) | No | No |

| RF Interference | None (uses light) | Moderate (2.4/5GHz congestion) | High (2.4GHz crowding) |

| Power Consumption | Low (LEDs efficient) | Medium-High | Low |

| Latency | Very Low (<1ms) | Low (5-20ms) | Medium (20-100ms) |

| Setup Complexity | High (alignment critical) | Low (automatic) | Very Low (automatic pairing) |

| Ideal Use Cases | Secure rooms, RF-restricted areas, high-bandwidth local transfer | Internet access, networking, general data transfer | Personal devices, audio streaming, IoT |

Working Demonstration of the Wireless Audio Transfer Project

After successfully assembling the components, we began testing the project. It works well both indoors and outdoors, regardless of the conditions. The range of the wireless transfer is impressive, as the intensity of the laser does not diminish significantly under clear weather conditions. As long as the laser beam hits the solar panel, the audio is transferred seamlessly. We also tested the setup from multiple angles and encountered no issues.

The image above was taken while testing the setup outdoors. Unlike other projects, I did not include any GIFs to show the working process, but we have made a video that you can watch below. The video provides a complete demonstration and explanation of the project.

Range Testing

| Environment | Expected Range | Limiting Factors | Optimization Tips |

| Indoor (low light) | 10-50 meters | Ambient light interference, beam dispersion | Test at night, use larger solar panel, shield receiver from room lights |

| Outdoor (clear) | 50-100+ meters | Atmospheric turbulence, precise alignment needed | Use stable mounts, test during calm weather, consider beam collimation lens |

| Outdoor (bright sun) | 5-20 meters | Sunlight overwhelms laser signal | Shade receiver, use IR laser (780nm), add optical filtering |

Troubleshooting Common Issues

Resolve problems with your laser transmitter receiver system using these diagnostic steps:

Problem | Possible Causes | Solutions | Prevention |

No sound from receiver | • Misaligned laser

• Incorrect bias voltage

• Dead battery

• Faulty connections | • Re-aim laser at solar panel center

• Adjust bias potentiometer through full range

• Check battery voltage (>7V)

• Verify all wire connections with multimeter | Use mounting hardware to maintain alignment, mark optimal potentiometer positions |

Distorted/crackling audio | • Excessive transmitter gain

• Overdriven laser

• Ambient light interference

• Poor bias setting | • Reduce MAX4466 gain (turn CCW)

• Lower PAM8403 output (transmitter)

• Shield receiver from direct light

• Fine-tune bias for minimum noise | Start with conservative gain settings, test in controlled lighting |

Very weak audio | • Low transmitter gain

• Weak laser power

• Small solar panel

• Partial beam blockage | • Increase MAX4466 and PAM8403 gain

• Check laser brightness visually

• Use larger photodetector

• Clear line of sight | Use recommended components, avoid cheap undersized solar cells |

Laser not lighting | • Reversed polarity

• No current limiting resistor

• Dead laser diode

• Insufficient drive voltage | • Check laser +/- connections

• Add 30Ω series resistor if missing

• Test with fresh 3V supply directly

• Verify 5V at PAM8403 output | Always use current limiting, verify polarity before powering on |

Intermittent audio | • Vibration/movement

• Loose connections

• Atmospheric turbulence (outdoor)

• Battery voltage drop | • Secure transmitter/receiver to stable surfaces

• Re-seat breadboard connections

• Test indoors to isolate cause

• Replace batteries | Solder permanent connections, use fresh batteries, mount on tripods |

Excessive noise/hum | • Ground loop between units

• Missing filter capacitors

• RF interference

• Inadequate power supply | • Use separate batteries for TX/RX

• Add 100µF capacitors across power rails

• Keep wires short and bundled

• Verify 7805 provides clean 5V | Use battery power (not wall adapters), add proper filtering from start |

Some of the Improvement Ideas & Additional Possibilities for this Wireless Audio Transfer Project

These are some of my ideas for extending this project, which you can give a try.

Improvement ideas:

Use a more sensitive photodetector instead of a toy solar panel, such as an avalanche photodiode (APD), to improve the reception quality and range.

Implement a focusing lens system to concentrate the laser light on a smaller, more sensitive area of the photodetector.

Introduce noise reduction techniques and filters to improve the audio signal quality.

Some sort of Automatic Alignment System to ensure optimal signal transmission even with movement or misalignment.

Additional Possibilities:

Expand the project to support bidirectional communication by incorporating a similar setup on both ends, allowing two-way audio transmission.

Adapt the system to transmit not only audio but also other types of data, such as digital signals for internet communication, by incorporating appropriate modulation techniques.

Experiment with different laser wavelengths and power levels to extend the effective range of communication, ensuring long-distance transmission capabilities.

Design a compact, battery-operated version of the system for portability, making it suitable for mobile and field applications.

You have successfully built a fully functioning laser audio transmitter and receiver using LiFi technology. This wireless audio transfer using laser light project example illustrates basic ideas and principles of optical communication. The laser audio transmitter circuit serves as a great starting point for additional projects, which may include digital data transmitters, bi-directional communication systems, or long-distance optical links. Share your LiFi audio transmission project experience, ideas and comments, ask questions, and do some additional experiments with optical communications!

Frequently Asked Questions

⇥ 1) Can we use a laser in Li-Fi?

Of course, you can use lasers in a Li-Fi system. Practically, any light source, along with its sensor, can be utilised to create a Li-Fi system.

⇥ 2) Is LiFi Better than Wi-Fi?

Determining whether Li-Fi is better than Wi-Fi depends on various factors. Both have their own pros and cons. For a detailed explanation, visit our article LiFi vs WiFi.

⇥ 3) Is LiFi Safe for Humans?

Yes, LiFi (Light Fidelity) is generally considered safe for humans due to its non-ionising radiation, Low Power Levels, Limited Range, etc. Overall, LiFi is a promising and safe technology for wireless communication, offering a secure and efficient alternative to traditional radio frequency-based systems.

⇥ 4) Advantages and Disadvantages of LiFi?

Advantages of Li-Fi

High-Speed Data Transfer: Li-Fi provides exceptionally fast data transfer rates, often surpassing those of traditional Wi-Fi, by utilising visible light.

Enhanced Security: Since light cannot pass through walls, Li-Fi offers better security against unauthorised access compared to radio frequency systems.

No Radio Frequency Interference: Li-Fi avoids issues related to radio frequency interference, making it suitable for environments sensitive to such interference.

Reduced Latency: Li-Fi can achieve lower latency compared to Wi-Fi, benefiting applications requiring real-time communication and streaming.

Energy Efficiency: Li-Fi can make use of existing LED lighting systems, which are energy-efficient and help lower overall energy consumption.

Disadvantages of Li-Fi

Line-of-Sight Requirement: Li-Fi needs a direct line of sight between the transmitter and receiver, which can limit its range and flexibility.

Limited Range: The operational range of Li-Fi is shorter than that of Wi-Fi due to its reliance on visible light.

Indoor Use Only: Li-Fi is mainly effective in indoor settings where light can be easily managed and controlled.

Light Obstruction: Any blockage or interruption in the light path can disrupt the communication, impacting reliability.

Cost and Infrastructure: Implementing Li-Fi may require higher initial costs and changes to existing infrastructure, such as upgrading to suitable lighting systems.

⇥ 5) What is LiFi Used For?

Li-Fi (Light Fidelity) provides high-speed wireless communication by using visible light, ultraviolet, and infrared radiation for data transmission. It is employed in various settings, such as secure environments where radio frequency (RF) signals are restricted, including military and healthcare facilities. Li-Fi offers fast internet access and can be integrated with LED lighting systems to deliver both illumination and data transfer. It is advantageous in areas with high RF interference and is used to enhance applications like augmented reality (AR) and virtual reality (VR) with its superior bandwidth and low latency.

⇥ 6) What is SLD Laser LiFi?

SLD (Surface Light Emitting Diode) laser Li-Fi refers to a technology that utilises surface-emitting laser diodes to facilitate communication via light. Unlike traditional LEDs that emit light from a single point, SLDs distribute light over a larger surface area, which enhances the efficiency and performance of Li-Fi systems. In SLD laser Li-Fi setups, these laser diodes enable high-speed, high-bandwidth communication using visible light, offering faster data transfer rates compared to conventional LED-based systems. This technology is beneficial for applications demanding rapid data transmission and reliable performance, such as in urban environments and industrial contexts.

⇥ 7) Is laser audio transmission possible outdoors?

Yes. In clear weather, laser audio transmission is generally successful outdoors. The laser will maintain intensity over long distances without visible degradation. However, when establishing a laser audio transmission outdoors, fog, rain or anything else in the direct line of sight between the receiver and transmitter will completely interrupt audio transmission.

⇥ 8) What is the range of a home-built laser audio transmitter?

A simple home-made laser audio transmitter will typically provide audio clarity for around 10-50 meters in indoor conditions, or possibly 100+ meters in outdoor, line-of-sight conditions. The range will be determined by the laser output power, the sensitivity of the solar panel, the interference from the ambient light, and the atmospheric conditions. A more powerful laser will greatly increase the range of the transmitter.

⇥ 9) Is audio transmission using LiFi better than Bluetooth?

LiFi audio transmission encompasses greater bandwidth with no radio interference = however, it requires a direct line of sight. In contrast, Bluetooth is simple, portable, and adaptable. LiFi is preferred for radio frequency sensitive areas, such as hospitals and on an aircraft, while Bluetooth is more relatable to everyday use by consumers.

⇥ 10) What safety protocols are necessary when using laser transmitters?

Under any circumstances, would you want to expose lasers to the eyes, towards aircraft, and at reflective surfaces? If using a laser, then it is recommended to utilise Class 2 or laser systems that pose less than 1mW of risk! Post labelling, beam stops, and carefully constructing the placement of receivers to operate safely with the laser. It is advised not to keep lasers around children. If using a Class 3B or greater, protective eyewear and safety protocols are in place.

Projects in a Similar Realm

We have previously explored Li-Fi Technology in various innovative projects. You can check out the links below to learn more about them.

LiFi vs WiFi

The demand for faster and safer internet has made the highly intuitive human brain develop a new wireless technology called Li-Fi. What is this new term, Li-Fi, and how does it differ from Wi-Fi?

Li-Fi-based Text Communication between Two Arduino

Here in this project, we will be demonstrating Li-Fi communication using two Arduinos. Here, the text data is transmitted using an LED and a 4x4 keypad. And it is decoded on the receiver side using LDR. We previously explained Li-Fi in detail and used Li-Fi to transfer audio signals

Johannes Winkelmann is Sensirion's Director for Developer Experience, overseeing initiatives to support engineers in evaluating, prototyping, and designing solutions with sensors. With a background in Software Engineering and a decade of experience in developing software for embedded systems, wearables & mobile devices, he has spent the last ten years in the field of developer relations, with a secondary focus on building relationships with ecosystem partners.

Johannes Winkelmann is Sensirion's Director for Developer Experience, overseeing initiatives to support engineers in evaluating, prototyping, and designing solutions with sensors. With a background in Software Engineering and a decade of experience in developing software for embedded systems, wearables & mobile devices, he has spent the last ten years in the field of developer relations, with a secondary focus on building relationships with ecosystem partners.