The Taiwanese IDMs and IC design houses Winbond, Macronix and Nanya contributed US$53.9 billion that accounts for 9.7 percent of the global sales

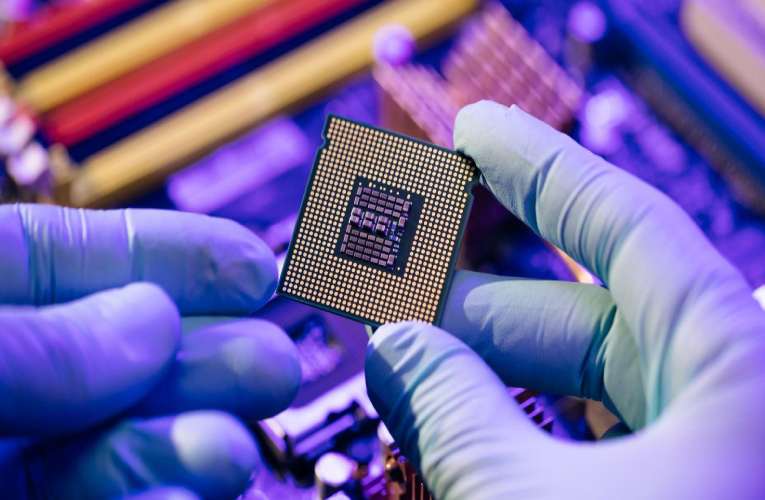

The global semiconductor sector coupled with skilled and top-notch labor has observed a terrific transformation and evolution for more than sixty years where the international capital market has played a pivotal role in shaping up the industry. The enhancement of this sector is a very intricate one from the fiscal or political point of view. Experts all over the world have thoroughly analyzed and examined the US$555.9 billion worldwide semiconductor market via various dimensions beyond the industrial output value.

The leading semiconductor companies based in the US such as Qualcomm, Nvidia, Intel, AMD, and TI have contributed US$273.9 billion of revenues that accounts for 49.3 percent of the international market and it has helped these companies to remain competitive and dominant in the worldwide market. Most of them completely depend on logic chips apart from Micron, which has also assisted them to become the international leaders in the market.

Basically, the semiconductor industry can be divided into two categories: non-memory and memory. According to an exclusive report of DIGITIMES, Memory products usually contribute 35-40% of the global semiconductor market, with non-memory semiconductor products including logic chips and control chips representing the rest. US-based Micron and Japan's Kioxia are major players in the memory market but Korean companies dominate the memory sector, which enables South Korea to have 19.3% of the overall semiconductor market.

Now, the point to be noted is that although South Korea is dominating the memory industry, it is now also trying to lead the market in wafer fab sectors and IC designs with a deep center of attention on contract chipmaking and Logic ICs and is trying to expand its industry more than just memory. In fact, another rival Taiwan also set its foothold quite strong in the global semiconductor industry. Apart from offering cutting-edge manufacturing services, it has also become highly successful in the IC design industry. Its IC design sector commenced from making chips for driver ICs, power management ICs, and for PCs in the 1990s. The Taiwanese IDMs and IC design houses Winbond, Macronix and Nanya contributed US$53.9 billion that accounts for 9.7 percent of the global sales