In order to meet the overall demand, the fabs capacity has been escalated to 95 percent, but they are not being able to counter the issue.

In the past two years, experts have mentioned that the chip manufacturing market has been extremely strained all over the world and the impediments in the supply chain will persist by the end of 2023 or early 2024. Semiconductor analysts have added that the production slump in this industry is not that new and they are cyclical. The production shortages can happen due to natural disasters, altering fiscal conditions, geopolitical scuffles, and also variations in the supply of semiconductor material.

Now, over the last 2-3 years, several businesses have shifted towards just-in-time inventory strategies, which is cost-saving and effective. It is beneficial when there are no shortages in the supply chain because this just-in-time strategy helps businesses to improve their inventory storage division and saves costs as the supply chain inventory volume is reduced. When the coronavirus pandemic commenced in 2020, car-makers massively decreased their chip orders as they were under an impression that sales will decrease to a larger extent.

Although manufacturing decreased, digitization has gained more momentum and the demand for consumer electronics and IT hardware products have augmented. Therefore, the semiconductor manufacturing companies have stopped making low-cost chips and started making the expensive ones. In order to meet the overall demand, the fabs capacity has been escalated to 95 percent, but they are not being able to counter the issue.

![]()

Tamera Max, who was associated with S&P Global as Director Technical Parts, said, "The global shutdown affected semiconductor manufacturing companies across the world, unilaterally stopping wafer production. Fabs in some countries were offline longer than others and, depending on how the production line was paused, it took weeks to months to bring a fab back online. Once a fab is online, it takes 26 weeks to fill the production pipeline from wafer start to completion."

"Wafers are processed in lots or batches that take 12 weeks to cycle through the fab (14 to 20 weeks for complex process technologies). An additional 12 to 14 weeks are required for testing, die bonding and packaging. Manufacturers prioritized the existing semiconductor inventory to fill orders, so as fabs came back online, production was already lagging demand. Longer lead times made it difficult to meet demands, and semiconductor manufacturers found that increasing capacity was not enough to make up for the difference between supply and demand," added Tamera.

Even before the COVID-19 scenario, there was a huge demand for semiconductors that was putting a huge pressure on the production units and in the logistics. It is just that the pandemic augmented that pressure in various ways. The entire supply chain was impacted both in the transportation sector and shipping and also reduced the volume of human workforce. Compared to other manufacturing sectors, the chip industry is very technical and around 25 percent of the workforce during that time was affected with the infection and quarantined.

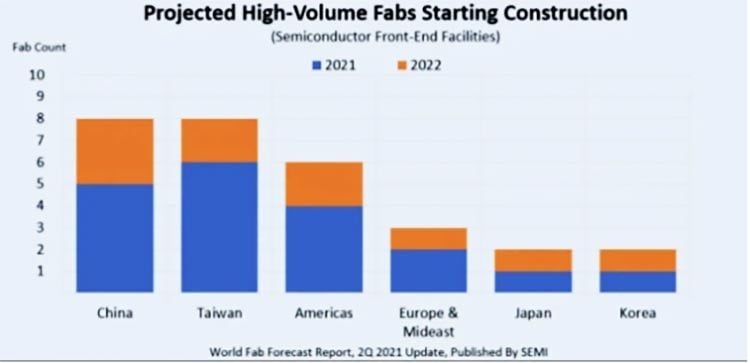

In 2021, chip-makers and the foundries have decided to set-up 29 new chip manufacturing units and many of these top-notch fabs are located in Taiwan and in China, which is followed by Korea, Japan, and the US. Around 14 fabs commenced constructing new factories in 2021 for 300 mm technology and in 2022, another 10 fabs decided to build new units. Technically speaking, a fab construction can be completed in two years and an additional year is required to install the machinery. According to the analysts at S&P Global, around 200 fabs with 300 mm technology will be fully operational by the end of 2026. The point to be noted is that most of the chip-making firms have started building their assembly and packaging division in-house, but 80 percent of the fb units are still located in China, South Korea, Japan, and Taiwan.

Akshara Bassi, Senior Research Analyst with Counterpoint Research told CircuitDigest, "Biggest supply chain challenge for the semiconductor ecosystem is concentration of manufacturing of advanced semi chips in Taiwan. Additionally, the foundry equipment suppliers lead times to deliver fab equipment and investments required to open new fab pose challenges to expand global foundry footprint.”

“The countries are indulging in inshoring and allyshoring activities to bring manufacturing of chips that would help in derisking geopolitical risks with chip manufacturing. In 2023, the pricing of semiconductor components also posed a significant challenge as price erosion happened due to oversupply of components. Another risk due to global geopolitical situations are the availability of raw materials which have come under restrictions. China has restricted exports of Gallium and Germanium or the Russia-Ukraine war impacted supply of Neon gas,” added Akshara.

And apart from the pandemic, the chipset making firms went through a lot of additional challenges, which further affected the international supply chain. For instance, in March 2021, the Renesas fabrication plant went up in flames, which halted the microcontroller manufacturing for over three months. This is extremely essential for the automotive industry. After that there was a massive ice storm in Texas in February 2022, which affected the power supply. Therefore, NXP, Infineon, and Samsung fabs failed to operate for several months. Moreover, there was a huge fire in Ukraine that affected the production of semiconductor packaging material. Most importantly, the continuous lockdowns in China reduced the volume of workforce in both electronics components and semiconductor manufacturing plants.

Highlighting the challenges of global semiconductor supply chain issues, Anku Jain, managing director of MediaTek India said, “The demand of semiconductor chips soared five to seven years prior to the COVID. This is mostly due to rising demand for consumer electronic items, smartphones, cars, and IT hardware products. COVID has just increased the demand to a certain extent. The global semiconductor companies and the foundries have done exceptionally well to increase production rate within a very short span of time. After a massive pandemic scenario, it’s a commendable task by both the manufacturers and the government. In the coming two years, the situation will not only return to normalcy, but the volume of production will increase by two-folds.”

While speaking of the entire international semiconductor supply chain, it is important to understand that chipsets are extremely intricate to manufacture and design. There are no sectors, which same amount of investments in both R&D and capital expenditure. The requirement for in-depth technical knowledge and scale has helped in forming a massive global supply chain in which every country performs different functions. For example, the US spearheads the R&D based activities such as electronic design automation (EDA), core intellectual property (IP), chip design, and advanced manufacturing equipment. While the East Asian countries are extremely brilliant in wafer fabrication that requires huge capital investments backed by the government schemes and initiatives. China is at the forefront in assembly, packaging, and testing (ATMP), which does not require much proficiency and investments.

A media report has also added that in the coming ten years, the global semiconductor industry will have to have an investment of $3 trillion in R&D and capital expenditure. In an effort to meet the same, both the government and the industry leaders will have to work together to provide state-of-the-art access to markets, talent, technologies, capital, and make the supply chain more sturdy. Throughout the supply chain, there are about 50 points where one country has more than 65 percent of the international market share. When we speak about the overall semiconductor supply chain, manufacturing is the key. According to a report of Semiconductors Industry Association (SIA), around 75 percent of manufacturing units and suppliers of important materials are located in East Asia and China.

Both the regions are surrounded with geopolitical tensions and high seismic activity. Moreover, the cutting-edge semiconductor manufacturing capacity in 10-nm nodes are concentrated in Taiwan (92 percent) and South Korea (8 percent). To counter the challenges of international supply chain imbalances, governments must unleash market oriented incentive schemes that will help in setting-up more production units, especially in the US as well as expanding the volume of manufacturing sites and supply sources for critical components and equipment.